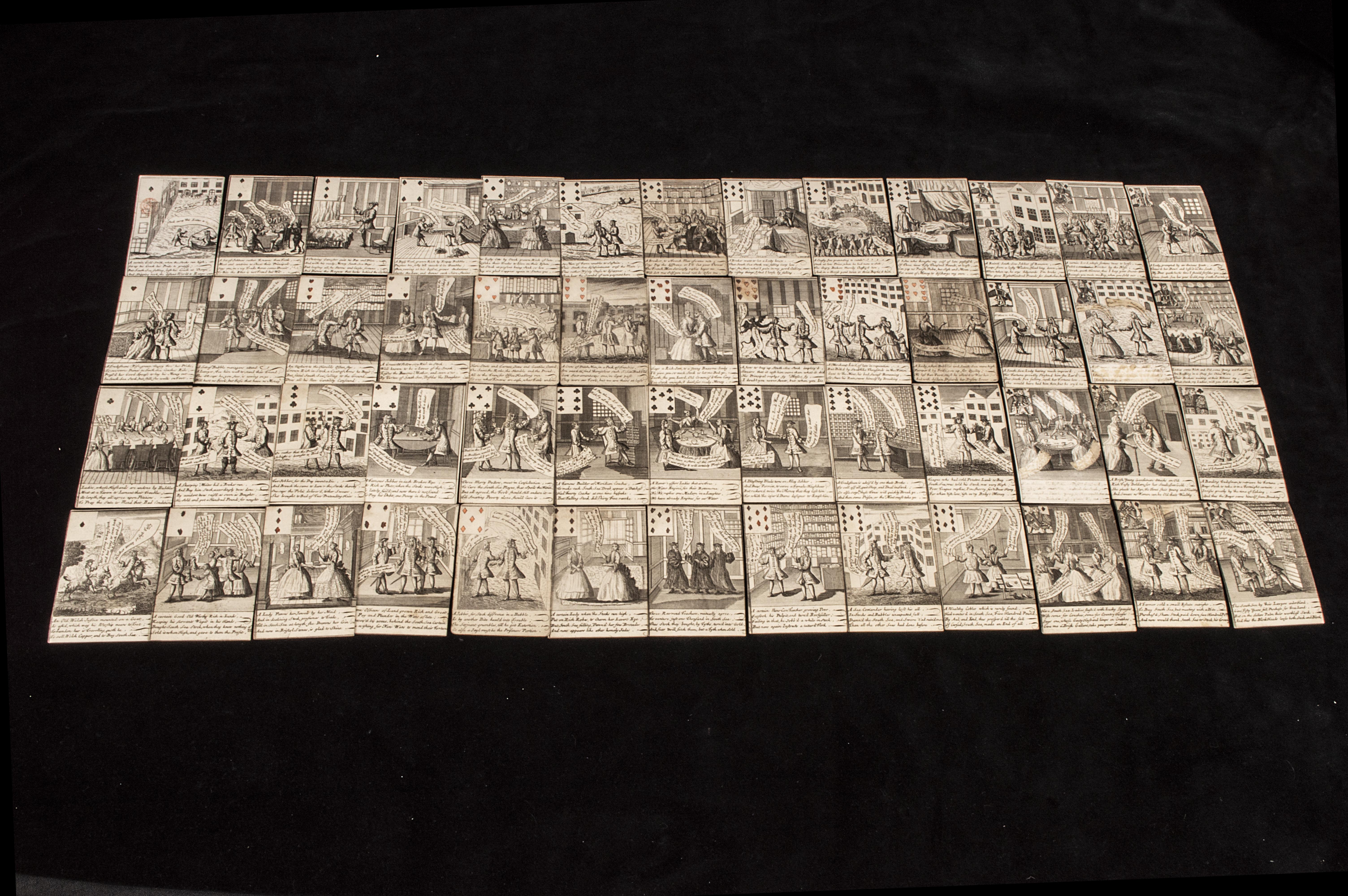

South Sea Bubble. The Bubbler's Medley, or a Sketch of the Times: Being Europe's Memorial for the Year 1720, printed for Carington Bowles No. 69 in St. Paul's Churchyard, London, circa 1765-80, etching on laid paper, watermarked, trimmed just inside plate mark, bears the number 23 to lower right corner, sheet size 33 x 24.5 cm (13 x 9.75 ins) (Qty: 1) Provenance: From the estate of John Lawson (1932-2019). A satirical print on the South Sea Bubble or financial crisis in England of 1720, first published by Thomas Bowles in the same year, and reprinted by his nephew Carington Bowles some time between 1764 and 1793 when Carington was in business. The image comprises a variety of trompe l'oeil printed broadsides, playing cards and ballads, as well as an anamorphic image of a man on a horse to the lower right corner. The South Sea Company was a joint stock company created as a public/private partnership, whose stock rose purely on speculation and rumour, aided by insider trading and bribery of politicians, only to crash spectacularly in 1720, severely impoverishing many of its investors, including Sir Isaac Newton.

South Sea Bubble. The Bubbler's Medley, or a Sketch of the Times: Being Europe's Memorial for the Year 1720, printed for Carington Bowles No. 69 in St. Paul's Churchyard, London, circa 1765-80, etching on laid paper, watermarked, trimmed just inside plate mark, bears the number 23 to lower right corner, sheet size 33 x 24.5 cm (13 x 9.75 ins) (Qty: 1) Provenance: From the estate of John Lawson (1932-2019). A satirical print on the South Sea Bubble or financial crisis in England of 1720, first published by Thomas Bowles in the same year, and reprinted by his nephew Carington Bowles some time between 1764 and 1793 when Carington was in business. The image comprises a variety of trompe l'oeil printed broadsides, playing cards and ballads, as well as an anamorphic image of a man on a horse to the lower right corner. The South Sea Company was a joint stock company created as a public/private partnership, whose stock rose purely on speculation and rumour, aided by insider trading and bribery of politicians, only to crash spectacularly in 1720, severely impoverishing many of its investors, including Sir Isaac Newton.

.jpg)

.jpg?w=400?width=1600&quality=70)

Testen Sie LotSearch und seine Premium-Features 7 Tage - ohne Kosten!

Lassen Sie sich automatisch über neue Objekte in kommenden Auktionen benachrichtigen.

Suchauftrag anlegen